The new Scottish corporate insolvency figures for August have been released and there’s good news and bad news.

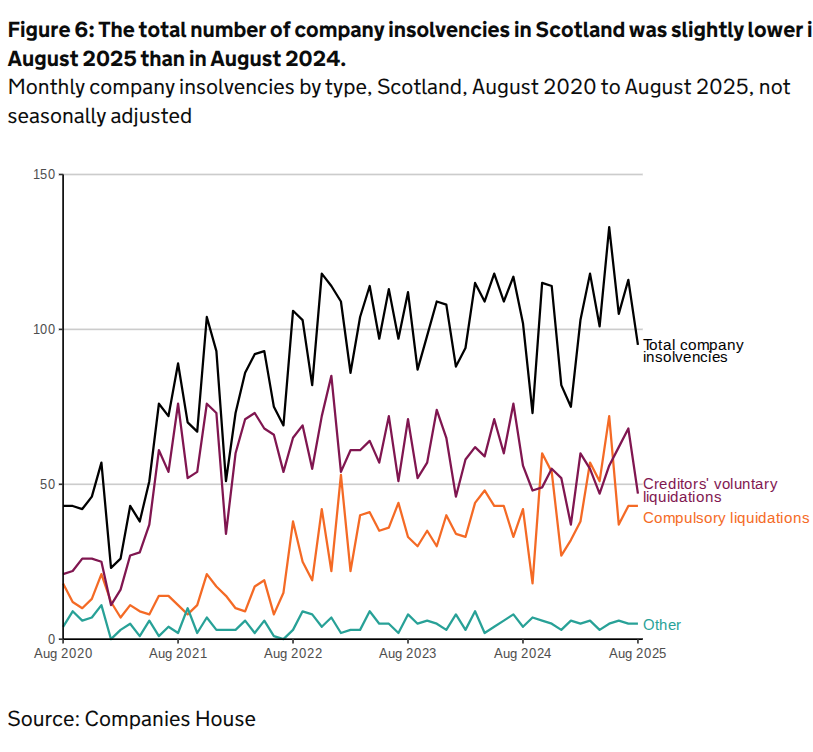

Last month there were 95 company insolvencies, which was 21 fewer than last month’s total and was also 7% lower than the same period from a year ago.

August’s total was made up of 47 Company Voluntary Liquidations (down from 68 in July); 43 compulsory liquidations (no change) and five administrations (up from four). There were no Company Voluntary Arrangements (down one) or receivership appointments.

Scotland’s insolvency regime is partly devolved.

The Accountant in Bankruptcy (AiB), Scotland’s insolvency service, administers the Register of Insolvencies which is a publicly accessible statutory register regarding the insolvency of individuals and businesses in Scotland including company liquidations and receiverships.

Between June 26th 2020 and August 31st 2025, there were three restructuring plans and one moratorium in Scotland. Both procedures were created by the Corporate Insolvency and Governance Act 2020.

Scotland had always traditionally seen more compulsory liquidations than any other kind of insolvency process but CVLs overtook them in April 2020 and had remained higher until March 2025.

CVLs again became the most frequent form last month overturning a three-month trend when compulsory liquidations had been higher.

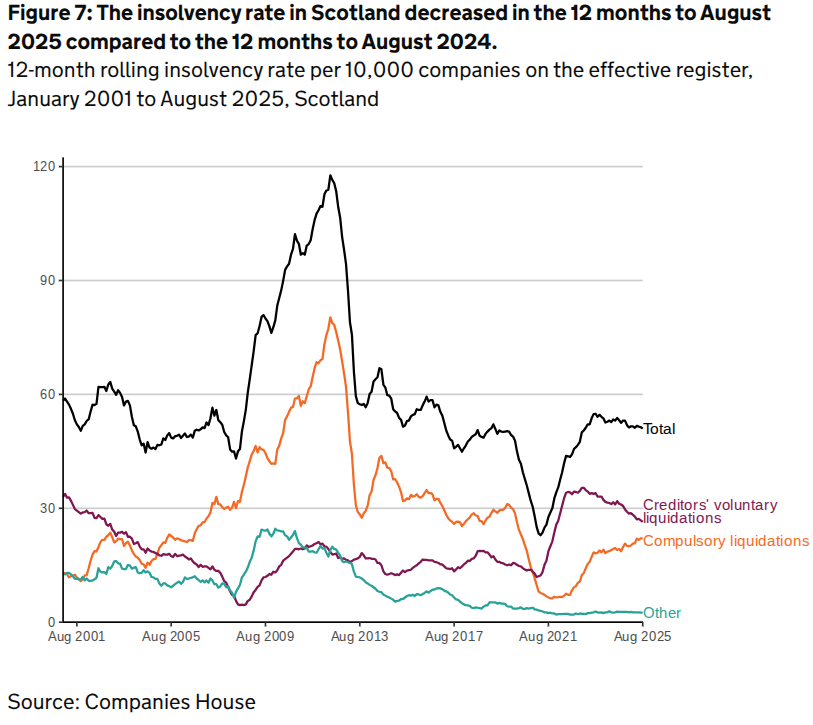

The total insolvency rate in Scotland in the 12 months to August 2025 was 51 per 10,000 companies on the effective register. This was down by 2.2 from the preceding 12 months ending August 2024.

Chris Horner, insolvency director with BusinessRescueExpert, said: “While the fall in Scottish insolvencies is positive, operating conditions continue to remain challenging.

“Consumer confidence remains weak and businesses are having to absorb significant cost rises in order to remain competitive. This puts acute pressure on margins and there are few signs of respite on the horizon – inflation can be described as “sticky” which is dampening demand and the recent decision to hold interest rates means borrowing costs are unlikely to drop again this year.

“Additionally, uncertainty over the November Budget means investment and hiring decisions are being delayed. For consumer facing businesses in particular, the next few months could be defining. If they don’t have a good final quarter of the year including Christmas and Hogmanay then they could have some difficult decisions at the start of 2026.”

As we pass the Autumn equinox and time itself changes, many directors are looking to make vital and valuable changes to their businesses and understand the time to do it is now.

Get in touch with us to arrange a free initial consultation about what options you could have to help your business be in the best possible shape for the last few months of 2025 and beyond.