But voluntary liquidations climb to their second highest monthly total in the past year

The new corporate insolvency figures for August have been released by The Insolvency Service and they’re a mixed bag of numbers with slight fluctuations without any big shocks or movement.

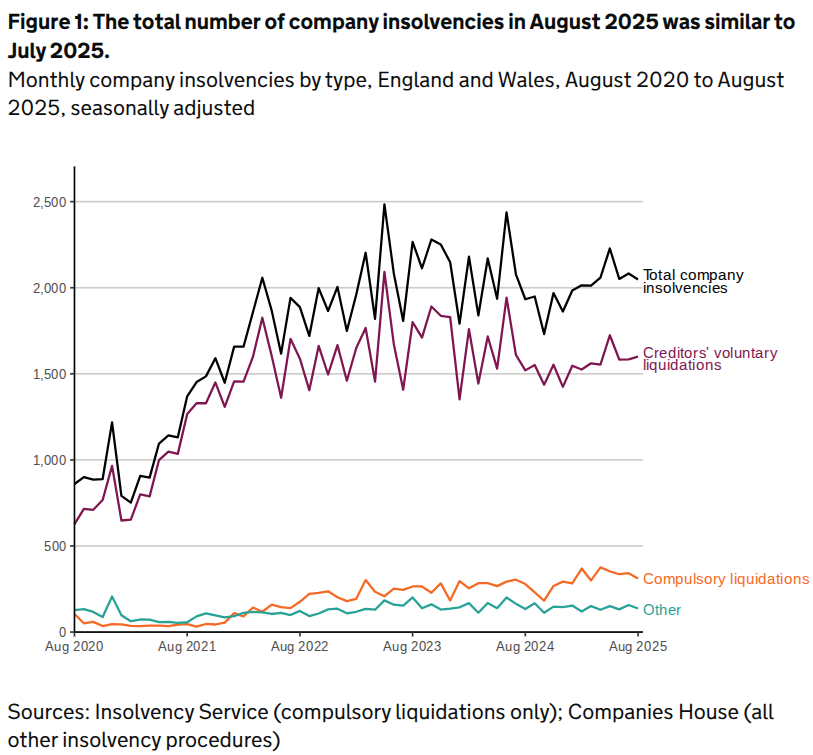

There were a total of 2,048 business insolvencies in England and Wales last month. This was a slight decrease (2%) on the previous month’s total of 2,081 but was 6% higher than the total from August 2024.

This was also the seventh consecutive month when overall business insolvencies have been over 2,000 and the current total numbers for 2025 are higher than their 2024 equivalents.

Analysis

Of the 2,048 corporate insolvencies recorded in August, the most frequent type once again were Creditors’ Voluntary Liquidations (CVLs) with 1,600 – the second highest monthly total in the previous 12 months.

This is an increase of 16 cases from July’s total (1%) is also 5% higher than the same month a year ago. CVLs made up 78% of all corporate insolvencies recorded in August, a 2% increase on the ratio from the previous month.

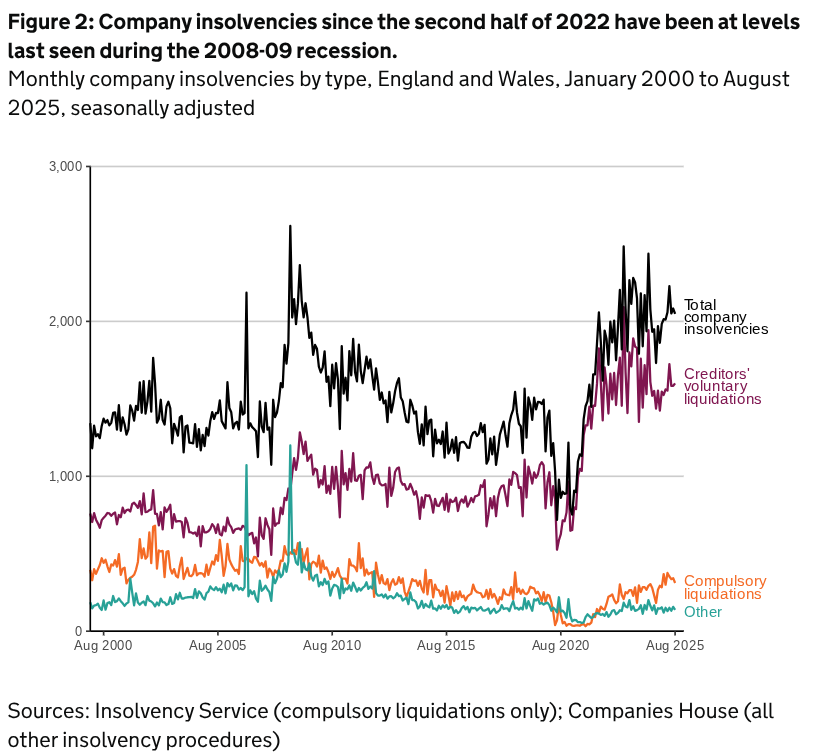

For context, the annual number of CVLs declined last year for the first time in four years. They peaked in 2023 to their highest annual total since the series began recording in 1960. Between 2017 and 2019, CVLs had been rising at approximately 10% a year but during the pandemic they fell to their lowest levels since 2007.

There were a total of 311 compulsory liquidations recorded in August. This was a 9% reduction in the number of cases from last month but an 11% increase on the total from the same month a year ago.

Contextually, these figures remain elevated in the first eight months of 2025 as HMRC continues targeting companies with outstanding Corporation Tax, VAT, PAYE and National Insurance Contribution (NICs) arrears, with increasing resources being allocated to investigating and recovering arrears.

In 2024, compulsory liquidations were at their highest levels in a decade with annual increases of 14%. This was a reverse of the historic low levels recorded in 2020 and 2021 when government restrictions stopped the use of statutory demands and winding-up petitions. Numbers have been increasing and catching-up this year.

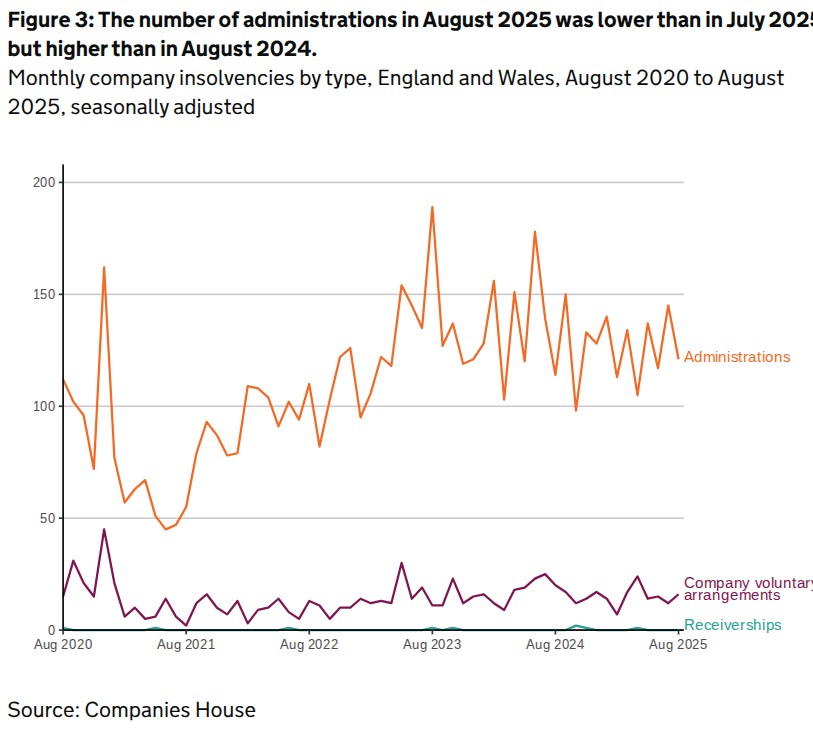

There were 121 administrations in August, which was 17% lower than July’s total but this was the highest monthly total since September 2024. It was 6% higher than the same month last year.

The number of administrations increased annually by 2% in 2024 and were slightly higher than the annual totals seen between 2015 and 2019. The number of administrations have been increasing since 2022 from an 18-year low seen during the pandemic in 2021.

There were 16 Company Voluntary Arrangements (CVAs) in August which were down 20% from last year’s total but 33% higher than in July.

While CVA numbers remain relatively low compared to historic trends, they increased 9% annually last year from 2023 and were 58% higher than those recorded in 2022 which was the lowest ever annual total in the time series going back to 1993. Despite this increase, the 2024 total was slightly less than 55% of the 2015 to 2019 annual average.

There were no receivership appointments in August with only four being recorded in the year to date. One restructuring plan was registered with Companies House in August with two moratoriums also registered.

Since June 2020, 64 companies obtained insolvency moratoriums to successfully pause legal action from creditors while they restructured financially while a further 53 had their restructuring plans registered at Companies House as required under the Corporate Insolvency and Governance Act 2020.

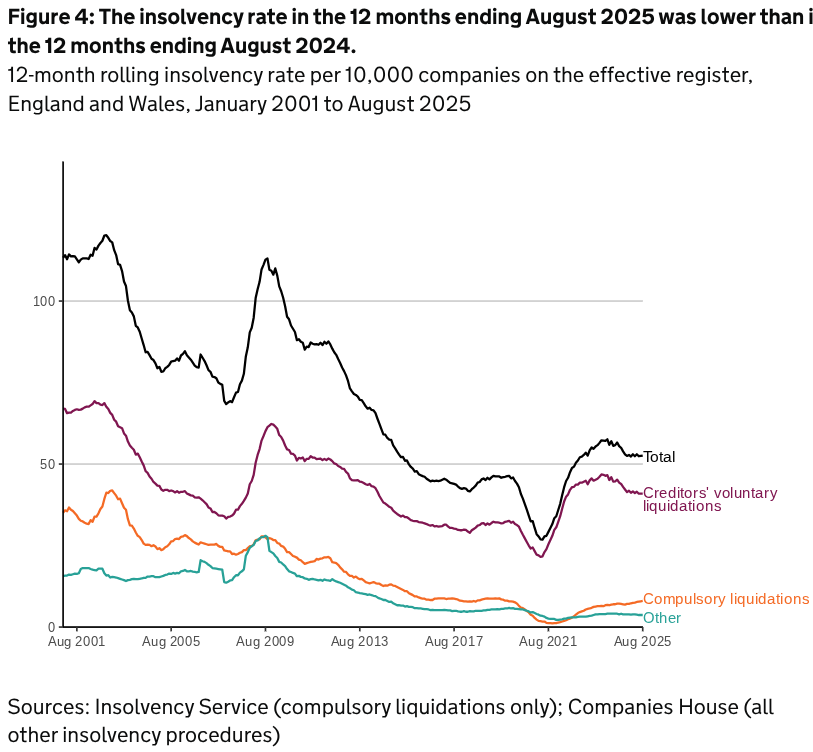

The rolling company liquidation rate in the 12 months to August 2025 was 52.6 per 10,000 companies which is one in 190 companies equivalent to entering insolvency. This is almost the same number it was last month (52.5).

Rolling insolvency rates are calculated as a proportion of the total number of companies on the effective register and are more comparable over a longer period of time than absolute numbers which can be more prone to short-term fluctuations.

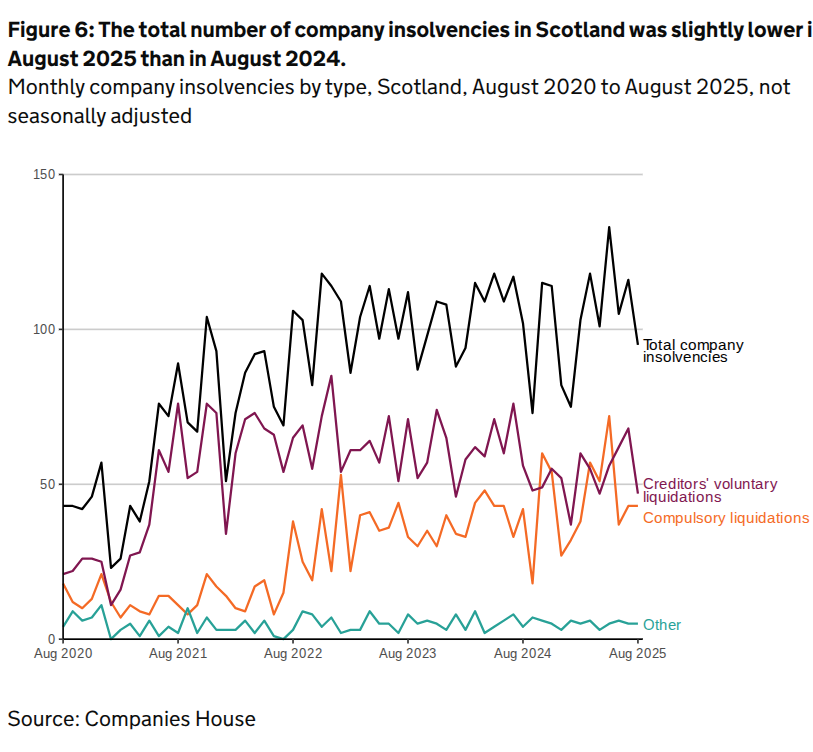

Scotland

In Scotland last month there were 95 company insolvencies, which were 21 fewer than last month’s total. It was also 7% lower than the same period from a year ago.

August’s total was made up of 47 CVLs (down from 68 in July); 43 compulsory liquidations (no change) and five administrations (up from four). There were no CVAs (down one) or receivership appointments.

Scotland’s insolvency regime is partly devolved.

The Accountant in Bankruptcy (AiB), Scotland’s insolvency service, administers the Register of Insolvencies which is a publicly accessible statutory register regarding the insolvency of individuals and businesses in Scotland including company liquidations and receiverships.

Between June 26th 2020 and August 31st 2025, there were three restructuring plans and one moratorium in Scotland. Both procedures were created by the Corporate Insolvency and Governance Act 2020.

Scotland had always traditionally seen more compulsory liquidations than any other kind of insolvency process but CVLs overtook them in April 2020 and had remained higher until March 2025.

CVLs again became the most frequent form last month overturning a three-month trend when compulsory liquidations had been higher.

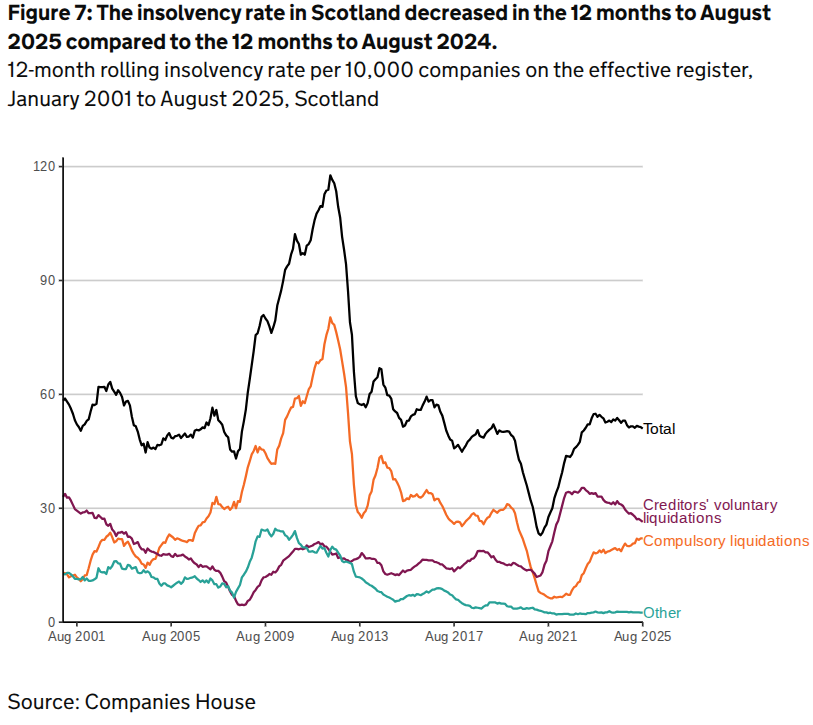

The total insolvency rate in Scotland in the 12 months to August 2025 was 51 per 10,000 companies on the effective register. This was down by 2.2 from the preceding 12 months ending August 2024.

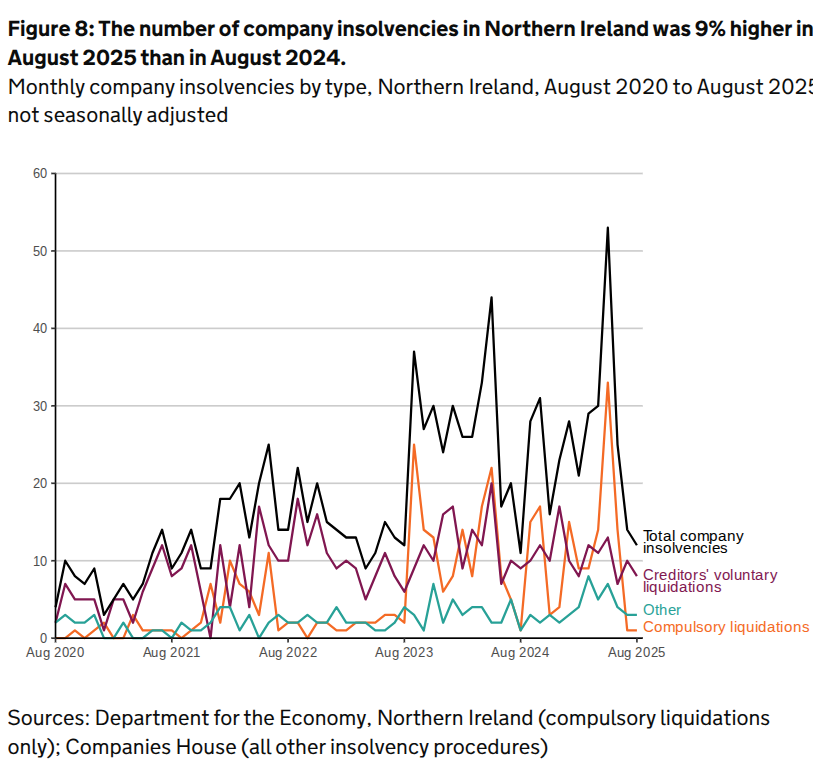

Northern Ireland

In August there were 12 company insolvencies registered in Northern Ireland.

This was two fewer than last month but was 9% higher than the total from August 2024.

August’s total was made up of eight CLVs (down from ten); one compulsory liquidation (no change) and three administrations (up from zero). There were no CVAs (down from three) or receivership appointments.

Between June 26th 2020 and August 31st 2025, there was one insolvency moratorium in Northern Ireland and no restructuring plans.

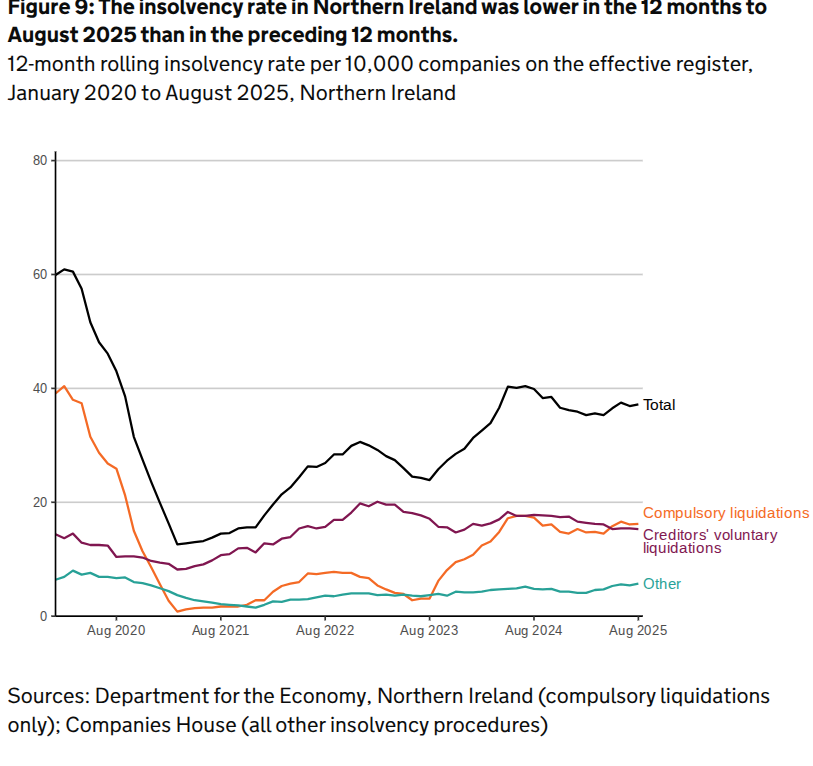

The total insolvency rate in the 12 months to August 2025 in Northern Ireland was 37.2 per 10,000 companies on the effective register. This was a decrease of 2.7 from the 12 months to August 2024.

The total number of company insolvencies for the whole of the UK in August 2025 was 2,155 – a month-on-month decrease of 56.

Meaningfull change is needed quickly

Tom Russell, Vice President of R3, the UK’s insolvency and restructuring trade body said: “For many businesses, uncertainty in what is already a difficult trading environment remains the dominant theme.

“The now confirmed November Budget is already casting a long shadow, with widespread speculation about possible changes to business taxation, such as the bank surcharge and business rates. Until the details are known, it is harder for directors and investors to make investment, recruitment and expansion decisions. This hesitancy has wider economic consequences for growth and productivity, as indicated by the latest disappointing GDP figures for July.

“The well-documented problems businesses face because of higher costs caused by inflationary pressures are also beginning to come to the fore again. Higher costs for energy and materials are once again eroding margins. Businesses cannot always pass these increases onto consumers, many of whom are themselves reducing discretionary spending.

“Interest rate expectations are a further constraint. While businesses had hoped for meaningful reductions in the cost of borrowing this year, the expectation now is that rates will remain at their current level for some time, in part because of inflationary concerns. This keeps the cost of servicing debt higher and makes new borrowing for investment harder to justify.

“Sector-specific pressures are also evident. Construction is struggling, with housebuilding slowing and smaller contractors reporting quieter pipelines. This is a sector that tends to feel changes in economic conditions quickly and many firms lack the reserves to withstand long gaps between projects. Retail and hospitality also continue to face difficulties with high staff costs, subdued consumer confidence and no major summer events to boost spending.

“A further update on transforming business rates is expected in the November Budget but for struggling retail and hospitality businesses meaningful change is needed quickly. The labour market is beginning to reflect this uncertainty.

“Unemployment continues to edge up while vacancies have fallen and high-profile industrial disputes contribute to a general sense of unease. Employers are often leaving posts unfilled or reducing hours but we are not thankfully seeing large scale redundancy. In some cases businesses are investing in technology and utilising AI and automation to ease cost pressures. This shift may increase productivity and help balance the books but it creates the perception of a cooling jobs market.”

As we pass the Autumn equinox and time itself changes, many directors are looking to make vital and valuable changes to their businesses and understand the time to do it is now.

Get in touch with us to arrange a free initial consultation about what options you could have to help your business be in the best possible shape for the last few months of 2025 and beyond.